Tax Summary

This report page will give you monthly, quarterly, and annual tax reports for all 50 US states over a given time period. The report only shows Settled credit card and check sales.

This report can be found under 'Reports' in the sidebar, then in 'Tax Summary' in the dropdown.

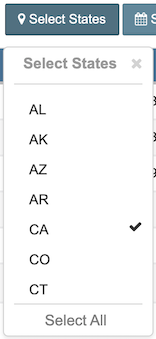

Select States

This dropdown allows you to select one or more states to generate the report. At the bottom of the dropdown there is the option to select all states at once.

By default, when opened, the report will only show the state that is set in the Merchant Profile, under the General Settings (Settings > General > Merchant). If this section has not been configured, the report will use the state entered at the time of creating the account. Once opened, you can select more states from the dropdown.

Reloading the report will keep the states selected. However, if you navigate to another page in the merchant console and then come back to the report, it defaults to showing only the merchant state.

The transactions are categorized first by the shipping state field, then the billing state field second if there is no shipping information. If the transaction has no shipping or billing information, the transaction will be categorized based on the merchant's state information, first from the Merchant Profile, then from the account information.

Select Period

This dropdown allows you to select the time period for the report. You have the choice of Monthly, Quarterly, or Annual. The title of the report will change to reflect the choice of period.

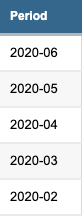

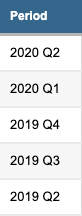

Here is a preview of what the Period column looks like when each Period is selected:

| Monthly | Quarterly | Annual |

|---|---|---|

|

|

|

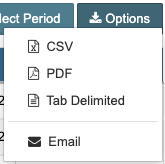

Options

These options allow you to export the currently viewed report. The formats in the dropdown are listed as follows:

| Format | Description |

|---|---|

| CSV | Clicking this option will export the currently viewed report to a CSV file. |

| Clicking this option will export the currently viewed report to a PDF file. | |

| Tab Delimited | Clicking this option will export the currently viewed report to a Tab Delimited file. |

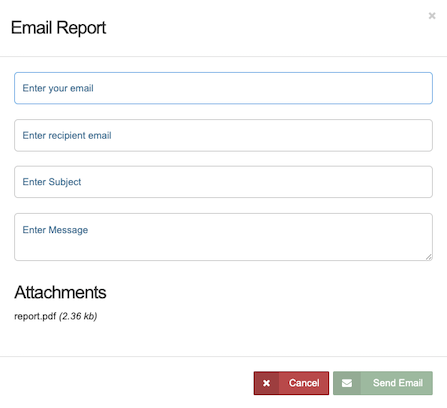

| Clicking this option will open a modal (pictured below) that once completed, will email the currently viewed report to an email address of your choosing in the form of a PDF file. "Your email" and "Recipient email" are required fields. |

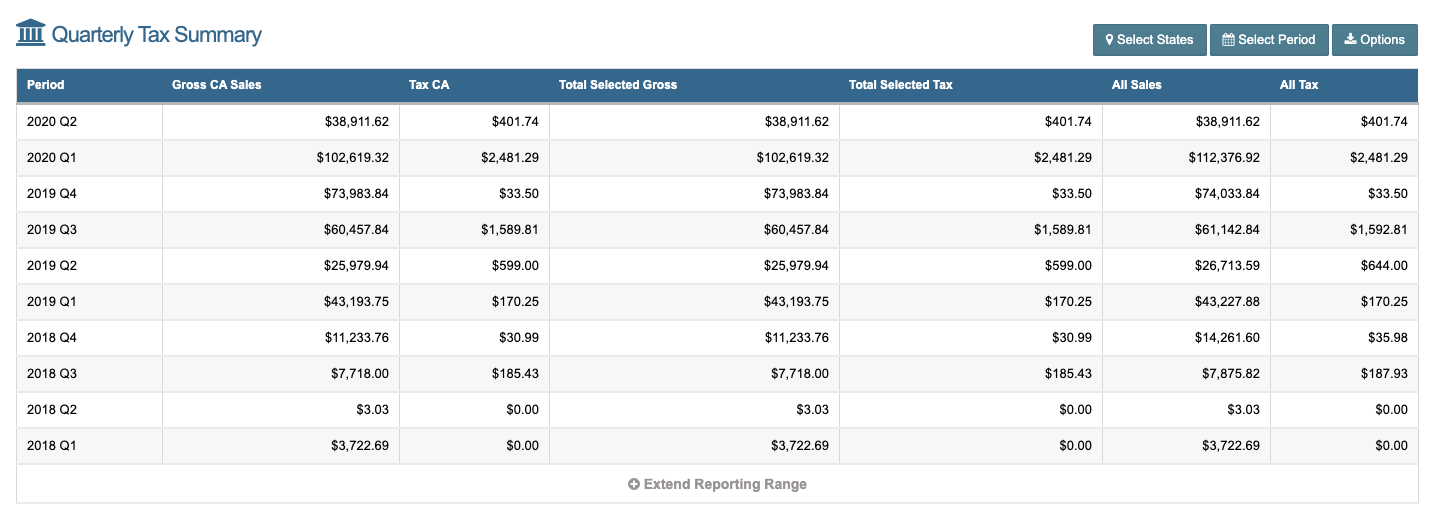

Summary

This is the summary report generated based off of the settings above. By default, the report starts with 5 rows and can be increased by clicking "Extend Reporting Range" below the visible rows.

This is the list of fields within the summary report:

| Field | Description |

|---|---|

| Period | Can be either Monthly, Quarterly, or Annual. Based off of the Select Period setting. |

| Gross STATE Sales | Shows the Gross Sales of each individually selected state. By default, the merchant's state will appear first. "STATE" will be replaced by each selected State from the dropdown and a new column will be created. This will extend the report horizontally across the screen and will require you to scroll to the left and right to view the whole report. |

| Tax STATE | Shows the Tax of each individually selected state. By default, the merchant's state will appear first. "STATE" will be replaced by each selected State from the dropdown and a new column will be created. This will extend the report horizontally across the screen and will require you to scroll to the left and right to view the whole report. |

| Total Selected Gross | Shows the Gross Sales of all selected States. Based off of the selected States from the Select State setting. |

| Total Selected Tax | Shows the Tax of all selected States. Based off of the selected States from the Select State setting. |

| All Sales | Shows the Sales of all 50 US States. |

| All Tax | Shows the Tax of all 50 US States. |